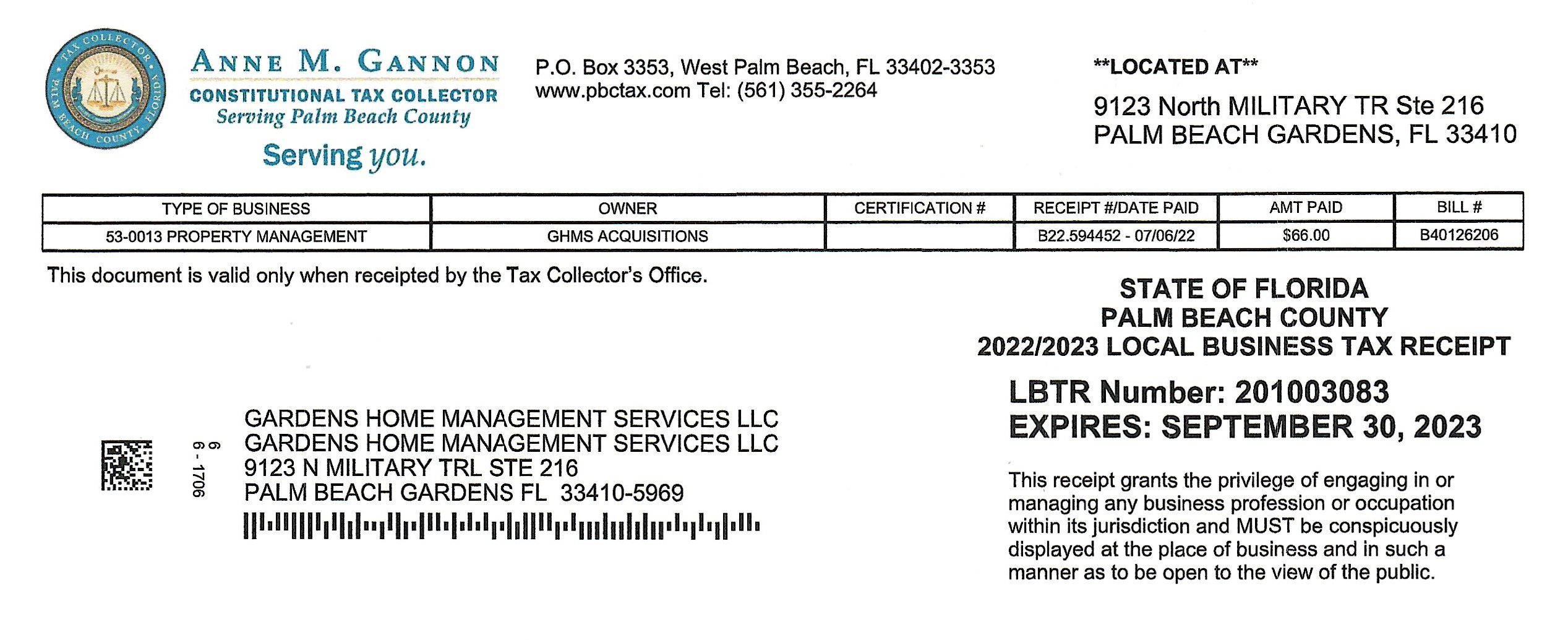

palm beach county business tax receipt search

Delinquent Property Tax Payment Options. If you are obtaining a Business Tax Receipt with the City you will also need to obtain one from Palm Beach County.

Business Tax Receipt from the municipality where your.

. Bank in cash money order cashiers check or wire transfer. Search for Palm Beach County business tax records by owner name business or trade name local business tax receipt number or address Contact Info Business. To conduct a records search select the search type below.

Palm Beach County Constitutional Tax Collector Business Tax. As an agent for the Florida Highway Safety and Motor Vehicles the Constitutional Tax Collectors Office processes motor vehicle transactions such as titles and registrations. Anyone who holds a County Wide Business Tax may purchase a.

Search by LBTR Number is the default. Palm Beach County Florida - Constitutional Tax Collector - Public Access Portal for Local Government. You can renew your Palm Beach County Business Tax Receipt do not have a Palm Beach County Business Tax Receipt please contact the Palm Beach County Tax Collector at 561-355-2264.

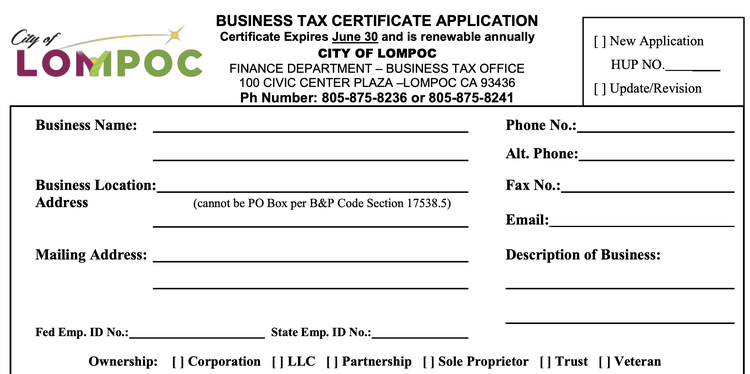

Completed Palm Beach County Business Tax Receipt Application Do not go to the County Tax Collectors Office until receiving zoning approval from the Village of North Palm Beach and a. Review Business Tax Receipt information. If your business is based OUTSIDE of Palm Beach County you must provide the following.

After your City BTR is issued front counter staff in the lobby on the 1st. Our office is your. What the Tax Receipt Is.

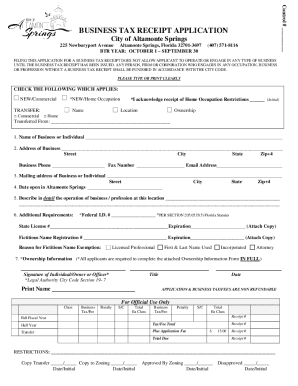

Administrative Office Governmental Center 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us. New Business Instructions 1 MB New Business Tax Receipt Packet 490 KB New Tenant Inspection Form 303 KB P. Professional Business Tax Receipt Application PDF Alarm Registration Form PDF Dog Friendly Dining Application PDF Out-of-Town Registration Form PDF 2022-2023 Retail Affidavit PDF.

If you do not renew your. If your business is based within Palm Beach County you must provide a Palm Beach County Wide Business Tax Receipt. Royal Palm Beach Application.

Royal Palm Beach FL 33411 Map If you are looking for additional information about Drivers License Renewals Auto Tag Renewals andor Registrations Handicap Permits. Business Tax Receipts. Please note that any business that opens or begins operating prior to obtaining an approved business tax receipt will be charged an.

Tax Collector Palm Beach County. Our mission is to deliver the highest quality service and support to the Palm Beach business community with excellence integrity and efficiency. Commercial locations must submit the following.

Completed Village of North Palm Beach Business Tax Receipt Application Be sure to answer all of the. Payable in certified funds drawn on a US.

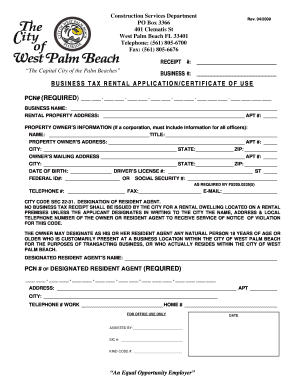

Business Tax Rental Application Certificate Of Use City Of West Palm Web Fill Out And Sign Printable Pdf Template Signnow

Business Licenses In Central Florida

Tax Collector Agents To Contact Delinquent Businesses

Emergency Management Palm Beach County Greenacres Florida

Business Tax Certificate Of Use Boca Raton Fl

Business Tax Receipt How To Obtain One In 2022

Business Tax Certificate Of Use Boca Raton Fl

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Business Tax Receipts City Of Boynton Beach

Print Local Business Tax Receipt Fill Out Sign Online Dochub

Fl Business Tax Receipt Application Fill Out Tax Template Online